Taiwan Futures Exchange (TAIFEX)

Taiwan

14F, 100 Roosevelt Road, Section 2

Taipei, Taiwan

Zip code 100

Tel: 886-02-2369-5678

www.taifex.com.tw

Established: September 1997

Type: Electronic

Contracts:

Stock Index

- TAIEX Futures (TX)

- TAIEX Options (TXO)

- Electronic Sector Stock Index Futures (TE)

- Electronic Sector Index Options (TEO)

- Finance Sector Stock Index Futures (TF)

- Finance Sector Index Options (TFO)

- TAIFEX MSCI Taiwan IndexSM Futures (MSF)

- TAIFEX MSCI Taiwan IndexSM Options (MSO)

- Mini-TAIEX Futures (MTX)

- Taiwan 50 Futures (T5F)

- NonFinance NonElectronics Sub-Index Futures(XIF)

- NonFinance NonElectronics Sub-Index Options (XIO)

- GreTai Securities Market Capitalization Weighted Stock Index Futures (GTF)

- GreTai Securities Market Capitalization Weighted Stock Index Options(GTO)

- NTD-Denominated Gold Options (TGO)

- Single stock futures

Equity

- Equity Options

Interest Rate

-

10-Year Government Bond Futures (GBF)

-

30-Day Commercial Paper Interest Rate Futures (CPF)

Commodity

-

TAIFEX Gold Futures (GDF)

-

TAIFEX NTD Gold Futures (TGF)

HISTORY

Taiwan Futures Exchange (TAIFEX) was established in 1997 and began trading in July 1998. The TAIFEX Clearing House is a department of the Exchange.

OWNERSHIP AND GOVERNANCE

TAIFEX had an initial capital of NT billion, which came from shareholders of four relevant industries, including futures, securities, banking, and securities/futures-related institutions. Total shareholding was kept at around 25% and each shareholder may not hold more than 5% otherwise approved by the Securities and Futures Bureau (SFB)**. The shareholders of TAIFEX are spread across a wide spectrum.

** In July 2004, Financial Supervisory Commission (FSC) was established. Securities and Futures Commission (SFC) was restructured and renamed as Securities and Futures Bureau (SFB) under the supervision of FSC.

ACCESS TO FUTURES MARKETS

Foreign investors can participate in the TAIFEX market through direct accounts and omnibus accounts.

A total of five TAIFEX products have been granted no-action letter by Commodity Futures Trading Commission (CFTC) and are permitted to offer and sell in the U.S. These products are TAIEX Futures, Mini-TAIEX Futures, Electronic Sector Index Futures, Finance Sector Index Futures and TAIFEX MSCI Taiwan IndexSM Futures. In addition, TAIFEX has been granted Part 30 Exemption by CFTC. The exemption allows designated TAIFEX members to market TAIFEX products in U.S.A directly to the U.S. investors. The exemption indicates that TAIFEX has met with the international standards.

TRADING

TAIFEX is a 100% electronic trading marketplace, and offers flexible interface compatibility for foreign FCMs to connect to the market.

TYPES OF ORDER

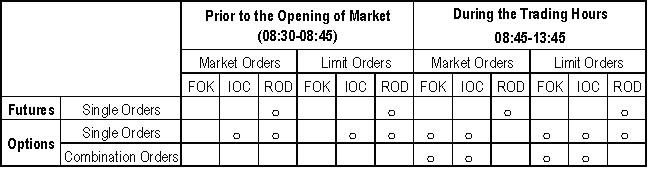

TAIFEX accepts two types of orders for execution - market orders and limit orders. However, an FCM may accept orders other than these two types at its own discretion, such as market-if-touched, stop, stop limit, one-cancels-the-other, market-on-close, straight cancel, and cancel replace orders.

CLEARING MECHANISM

The clearing and settlement process is undertaken by the Clearing Department of TAIFEX which has independent operations, finances and accounting from that of TAIFEX. Those who intend to conduct clearing business should apply for a clearing membership to the Clearing Department of TAIFEX. All FCMs have to clear their positions through a registered clearing member, which has to demonstrate financial compliance at all times.

MARGIN REQUIREMENTS

The methodology of setting margins for futures contract in TAIFEX is based on the volatility of the underlying within the last 180 days with the objective of covering 99.7% of the single-day price volatility risk. The margin required for the TAIEX futures from a clearing member is NT0 × Index × Risk Coefficient. Both NTD and USD may be accepted as margin deposit.

NEWS

See http://www.taifex.com.tw/eng/eng_home.htm for the latest on TAIFEX.